You just made an offer to your first employee. Congratulations! As a small business owner this is a BIG milestone, but it can also be a bit overwhelming. Now you are wondering what’s next??? What legal pitfalls do you need to avoid? How do you know if you’ve done All.The.Things that are legally required? What if you miss something?

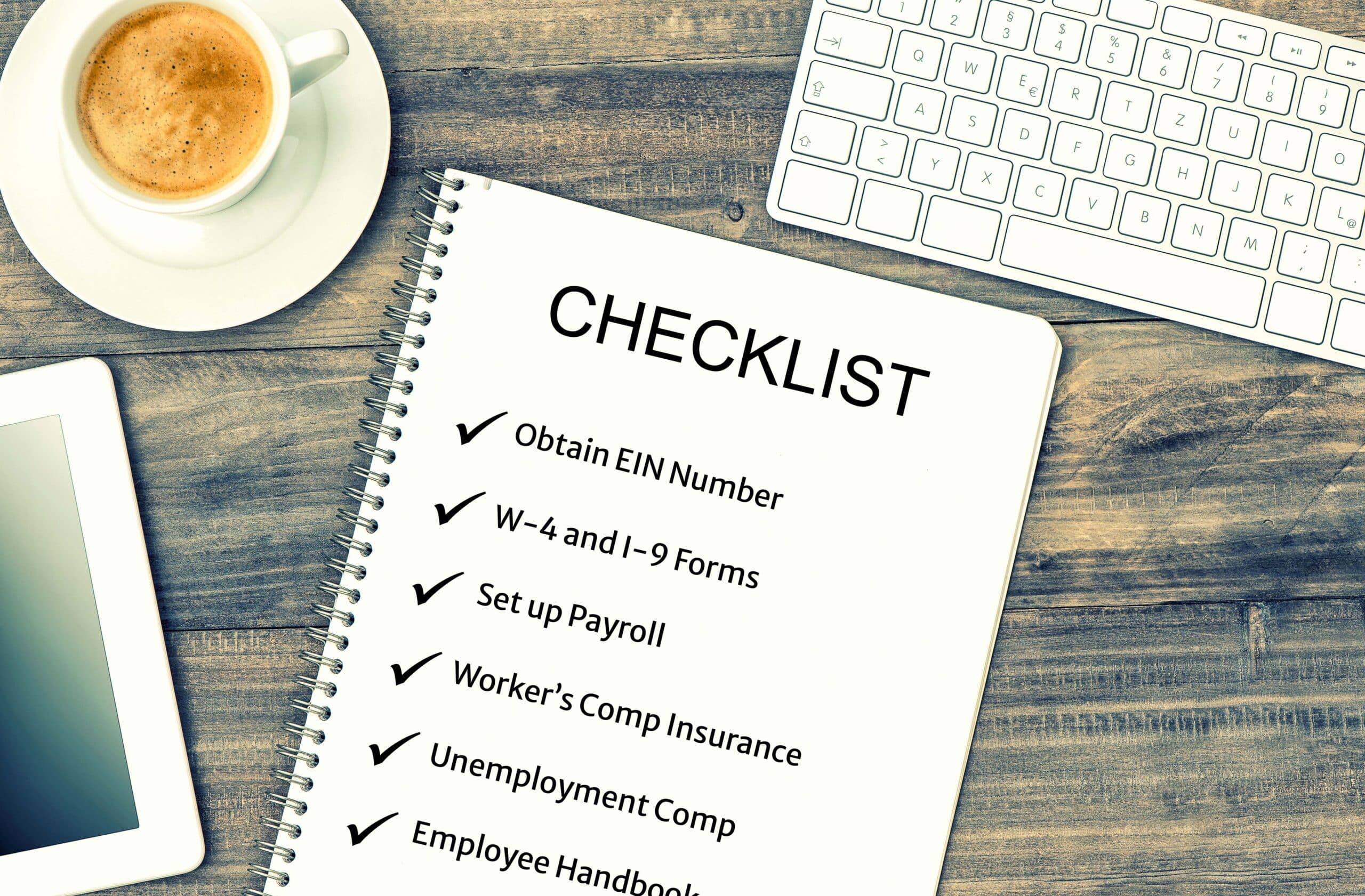

From obtaining an Employer Identification Number (EIN) to setting up payroll and creating an Employee Manual, there are several essential steps you must take to ensure your business remains legally compliant.

Here’s a checklist of your new obligations as an employer – so you can be sure you are doing this correctly from the start!

Get Your EIN

If you haven’t already obtained an Employer Identification Number (EIN), you can’t procrastinate on this any longer. An EIN is like a social security number for your business. It’s also known as a Tax ID Number (TIN) and is used for tax purposes, such as filing employment tax returns and reporting wages. Thankfully, an EIN is easy to obtain! File online here: https://www.irs.gov/businesses/small-businesses-self-employed/apply-for-an-employer-identification-number-ein-online

Fill Out The Forms

Of the many forms you need as an employer, two critical ones are the W-4 and the I-9. Your employee fills out the W-4 form for withholding taxes from their paychecks. The W-4 is available at www.irs.gov. Keep the completed W-4 in their personnel file.

Additionally, collect the information and fill out the I-9 for each new employee. U.S. Citizenship and Immigration Services (USCIS, formerly known as the INS) requires that all employers verify that every employee they hire is legally eligible to work in the United States. Maintain completed forms in an I-9 folder for all employees. Retain each form for at least three years and make it available for inspection by Immigration and Customs Enforcement. The I-9 form is available at www.uscis.gov.

Set Up Payroll

You must pay your employees regularly, and withhold employment taxes from their paychecks. Whether you choose to use a payroll service provider or do it yourself, make sure you understand the requirements for paying and withholding taxes and making your quarterly payments to federal, state, and local taxing authorities. And familiarize yourself with the laws regarding minimum wage, overtime pay, and employee benefits, which vary significantly from state to state.

Bind Workers’ Compensation Insurance

All states except Texas mandate workers compensation insurance. However, details such as the cost, which types of workers you must cover, and the fines for not having coverage vary greatly from state to state. Your anticipated payroll usually dictates the cost of insurance. And the carrier audits anticipated payroll against actual payroll at the end of each year, adjusting premiums to match the actual. So, keep your insurance carrier informed when you hire new employees or reduce staff to avoid a huge premium bill after the year-end audit.

Enroll in the Unemployment Compensation Fund

Register with your state’s Department of Labor for unemployment compensation taxes. Yes, even just one part-time employee triggers this requirement! Find the correct link for your state here: https://www.dol.gov/agencies/whd/state/contacts

Each state has their own rules on unemployment compensation. You pay these taxes into your state’s unemployment compensation fund. Then, the fund provides unemployment compensation benefits to workers who lose their jobs.

Report to Your State’s “New Hire” Program

As an employer, you must notify your state about each new employee. Your state uses this information to find parents who owe child support. Find your state’s reporting website at this link: https://www.acf.hhs.gov/css/contact-information/state-new-hire-reporting-websites

Post Required Notices

Both federal and state government agencies require employers to post notices in the workplace providing information on worker rights for their employees. Find information about federally required posters at www.dol.gov/elaws/posters.htm. This website has a “Poster Advisor” that helps you figure out which posters you are required to display. However, many of these will not be applicable unless your business deals with federal contracts. Find a link to information about your state posting requirements via this guide: https://www.findlaw.com/smallbusiness/employment-law-and-human-resources/required-labor-posters-state-guide.html If your business doesn’t have a physical location where employees report, post the notices on a shared drive of the company’s intranet, to a google drive, or in the Employee Handbook.

Create a Safe Environment

The Occupational Safety and Health Act (OSHA) requires employers to provide a safe workplace and training for employees to do their jobs safely. You can find information on these rules on the OSHA website at www.osha.gov.

Maintain Employee Records

For each employee you hire, create a personnel file. Keep all the employee related documents including applications, job descriptions, offer letters, the W-4 form, pay rate, time sheets, and reviews in the personnel file. And if you offer employee benefits, include the sign-up forms in the personnel file. Retention requirements vary, but expect to keep these records for at least three years after the employee is no longer with your company. However, not all documentation belongs in the personnel file. Maintain any medical records separately in a locked cabinet. Only employees with “need to know” should have access to medical records. Additionally, maintain I-9 Forms in a separate file as noted above.

Set Up Employee Benefits

Legal requirements for employee benefits vary by state and by company size. Even where offering employee benefits is not legally required, doing so is a valuable way to attract and retain employees. Benefits commonly provided by employers may include paid time off, medical and dental insurance, life insurance, and 401K, pension, or other retirement benefits.

Once you establish employee benefits, you’ll need a sign-up procedure so employees can enroll in medical insurance or retirement plans, name their dependents or beneficiaries, and select options. Your benefit providers should be able to help you with this one!

Create an Employee Handbook

Although not legally required, it is a good idea to have a handbook describing your company’s policies and making it clear that employment is at will unless an employee has signed a written employment contract. An employee handbook is a guide to your company’s culture, policies, and procedures. It typically includes information on company culture, benefits, paid time off, dress code, and disciplinary actions, among other things. Having an Employee Manual in place helps establish clear expectations for employees and can reduce the risk of misunderstandings and legal disputes.

Conclusion

In conclusion, hiring your first employee is a big step for any small business owner. And it comes with a range of legal obligations. By completing the checklist above, you are well on your way to ensuring that your business remains compliant, your employees are treated fairly, and clear expectations exist between employer and employee.

Need help navigating the process of bringing on that new hire? Let’s talk!